AUGSBURG, Germany — Quantron, a provider of zero-emission commercial vehicle technologies, is rolling out an expanding range of fuel cell electric and battery-electric trucks in Europe and plans to bring a fuel cell-powered Class 8 tractor to the North American market next year.

The Germany-based company, formed in 2019 as a spinoff of automotive supplier Haller Group, is partnering with original equipment manufacturers to outfit commercial trucks and buses with electric drivetrains and hydrogen fuel cell systems.

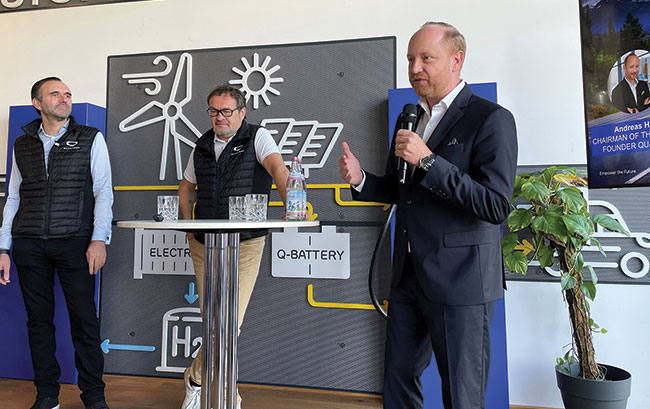

Quantron executives outlined the company’s vision for hydrogen fuel cell technology and provided a tour of the company’s headquarters during a Sept. 8 briefing with North American automotive and trucking journalists.

In addition to offering zero-emission vehicles, Quantron aims to provide a comprehensive platform to manage the complex ecosystem and partnerships involved in zero-emission mobility and logistics, including vehicle components, hydrogen fueling and electric charging infrastructure, as well as digital support and aftermarket and financial services.

Quantron founder Andreas Haller (right) speaks with North American trade media alongside CEO Michael Perschke (center) and CTO René Wollman. (Seth Clevenger/Transport Topics)

“We connect everything — the truck itself, infrastructure and digital services,” said Andreas Haller, Quantron’s chairman and founder.

The company is launching a range of heavy- and medium-duty vehicles in both battery-electric and fuel cell electric versions. The fuel cell vehicles utilize an electric drivetrain but use a hydrogen fuel cell system for energy storage rather than relying on the heavy batteries that power battery-electric trucks.

While Quantron’s initial vehicle models have been focused on the European market, the company also outlined its plans to launch a Class 8 hydrogen fuel cell tractor in the U.S. market next year, with the start of production targeted for the second quarter.

The conventional cab tractor will be equipped with an e-axle from Accelera by Cummins and 80 kilograms of hydrogen storage to provide a 750-mile range at maximum payload and less than 1,000 pounds of payload loss compared with a diesel model.

“Our goal is to be the range leader,” said Richard Ansell, Quantron’s vice president of marketing. “Trucking is all about efficiency, and that means maximizing payload, limiting downtime and quick fueling.”

Ansell said Quantron also has “a line of sight” on getting up to 120 kg of tank capacity, which could support a vehicle range of about 1,000 miles.

To build this vehicle, Quantron plans to open a 30,000-square-foot U.S. production facility in Auburn Hills, Mich., next year.

Quantron’s U.S. operations will be headed by Rick Haas, who previously held senior positions at Ford, Mahindra and Tesla.

Quantron is currently in discussions with truck manufacturers to provide the cab and chassis for the company’s heavy-duty fuel cell truck for North America.

During the press event, the company provided ride-along demonstrations of its medium-duty Quantron QLI fuel cell electric truck powered by Ballard Power Systems’ FCmove MD fuel cell power module. The vehicle offers a range of up to about 450 kilometers, or 280 miles, and refueling times similar to a diesel model, Quantron said.

North American automotive journalists ride along in Quantron’s medium-duty fuel cell electric QLI model at the company’s headquarters in Augsburg, Germany. (Quantron)

The company also offered a look at the production process for its Quantron QHM Aero cabover tractor, which provides a range of 700 km, or 435 miles, with a hydrogen tank capacity of 54 kg. The tractor requires no special exemptions to meet European vehicle length restrictions because the fuel cell system components, including the tanks, are packaged inside the chassis rather than on the back of the cab.

“Our truck with 54 kg of hydrogen has exactly the same weight as a diesel truck,” said René Wollman, Quantron’s chief technology officer. “There is no increase in weight, so no payload losses.”

A battery-electric truck would require battery packs weighing 6-7 tons to store the same amount of energy, he said.

“We love battery-electric vehicles as well, but not for longhaul,” Wollman said.

For some markets such as Norway that allow additional tank capacity, Quantron can package more hydrogen tanks behind the cab of the QHM Aero to support a range of up to 1,500 km, or 930 miles, and a refueling time of 15 minutes.

The company said it believes its fuel cell electric vehicles can achieve total-cost-of-ownership parity with diesel trucks by 2026.

While factors vary across different markets, the company projects that lower hydrogen costs and government subsidies for zero-emission vehicles will bring the TCO calculations for fuel cell trucks in line with traditional diesel trucks, which will become more expensive over time as manufacturers comply with tighter emissions regulations.

Haller said Quantron is targeting the same general time frame for TCO parity in Europe and North America. Although diesel prices are much lower in North America than Europe, he projected that green hydrogen also will be available at a significantly lower price than in Europe, he said.

The company also is working to address perhaps the biggest obstacle for the rollout of fuel cell vehicles — the availability of hydrogen fueling infrastructure to support them.

“Quantron is here basically to solve the hen and the egg problem of the hydrogen economy,” CEO Michael Perschke said.

Rather than producing green hydrogen itself, Quantron sources the fuel through agreements with international producers.

In the United States, Quantron is partnering with Irvine, Calif.-based FirstElement Fuel, which claims 80% of the hydrogen fueling market share in California.

FirstElement founder Shane Stephens said the company has dispensed about 6 million kg of retail hydrogen for fuel cell electric vehicles since the company’s inception 10 years ago.

Quantron joins a growing list of manufacturers investing in the rollout of hydrogen fuel cell commercial vehicles in North America.

Startup truck maker Nikola Corp. recently began series production of its fuel cell trucks equipped with Bosch’s fuel cell modules.

Paccar, the parent of Kenworth and Peterbilt, plans to introduce tractors equipped with Toyota’s fuel cell systems with production slated to begin in 2025.

Meanwhile, Daimler Truck and Volvo Trucks are investing in hydrogen fuel cell development through their Cellcentric joint venture.

Hyzon Motors and Hyundai also are rolling out fuel cell powered trucks in the North American market.